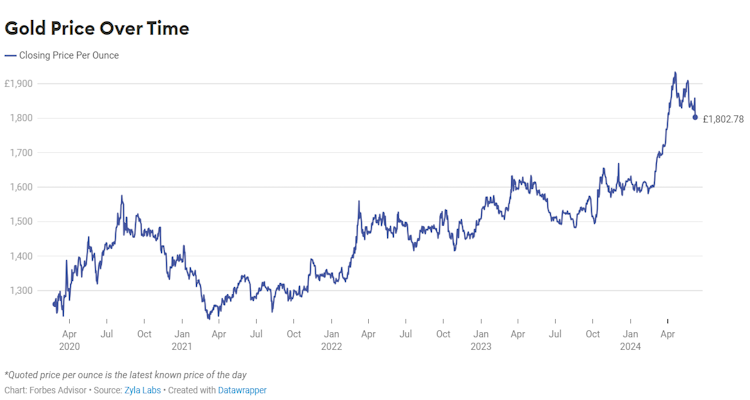

The price of gold reached record levels recently. Countries such as the United Kingdom, the United States and Australia, among others, have been experiencing marked inflation, often leading to cost of living crises.

Investors could then have expected the price of gold to rise sharply because of its status as a hedge against inflation. And yet, gold had been correcting for several months.

Evolution of gold prices in 2024

The yellow metal perfectly played its role as a safe haven in times of geopolitical uncertainty and stock market turbulence, as the conflict between Russia and Ukraine intensified. Gold is a historical hedging tool against inflation, since it theoretically retains its value over time. Its price often reacts to inflation figures, but this is not always the case.

Although gold generally gains ground when the cost of living increases, this relationship has faded somewhat since the 1970s. The relationship between gold’s performance and variations in price increases is indeed increasingly weak since that date.

High inflation prompted the US central bank response that strengthened the US dollar. To combat high inflation in the United States, the American central bank (the Fed) has sharply raised its key interest rates since 2022. In the minutes of its last meeting, it indicated that it was ready to continue its rate increases until inflation fell sustainably. The markets therefore anticipate further rate increases. This position of the Fed supports the American dollar which reached levels not reached since 2002.

The currency benefits from the tightening of the Fed’s monetary policy, since higher rates attract foreign investors looking for better investment opportunities. Investments in dollars in fact earn more and more as rates increase. They are also more profitable compared to countries with lower interest rates. The more investors they attract, the more they buy US dollars to be able to make their investments, thus increasing demand and, by extension, the value of the greenback.

But this strength in the USD have weighed on the price of gold. The greenback and gold are in fact negatively correlated assets, that is to say they tend to move in opposite directions. Since gold is denominated in US dollars, any price fluctuations in the US currency will impact the value of gold. So, when the value of the dollar increases, the price of gold tends to decrease because it becomes more expensive for those holding foreign currencies – and vice versa.

Higher U.S. Interest Rates Support U.S. Treasury Yields

The tightening of the Fed’s monetary policy has also had a strong impact on the bond market, whose yields are exploding. This sharp rise in American bond yields, particularly the American 10-year bond, has had a negative influence on the price of gold. The two assets are in fact negatively correlated and it is this negative correlation which partly explains the current correction of gold which is under pressure with the rise in long-term rates.

Why are gold and US Treasury bond yields negatively correlated

We must first consider these two assets as safe havens to understand their inverse relationship. Then, we must not forget to take into account the opportunity costs linked to holding gold, which offers no return, while bonds do. When yields are high, then investors turn more to bonds than gold – and vice versa when bond yields fall.

The lack of returns from gold also pushes investors towards other potentially more profitable investments, causing the current demand for gold – and therefore its price – to fall. Before making any investment decision, investors analyze the return potential of an asset and its ability to generate a gain or a cash flow, such as coupons in the context of bonds. Since no returns are offered by gold, investors are abandoning the yellow metal for other investment opportunities that offer better chances of making profits.

So, is gold still a safe haven asset against inflation? Gold generally acts as a hedge against inflation in the very long term, but with certain exceptions depending on the overall economic context and the stage of the Fed’s monetary policy.

In any case, its short-term performance does not really reflect its status as a safe haven against inflation for the reasons we have just mentioned. On the other hand, the situation could change if the risks of recession increase sharply or if the Fed slows down the pace of its rate increases.

What other investments should you favor in the event of high inflation

If you want to integrate investments that could protect you against inflation and the rise in rates that it causes, you have several choices to turn to.

You can invest in stocks that can benefit from inflation. First of all, these are those which have the possibility of passing on the increase in costs to the end consumer, such as large international brands with significant pricing power.

You can then support those who sell products or services necessary for everyday life such as food, drinks or medicine. It is also possible to buy banking and financial stocks which can benefit from the rise in interest rates to maintain or improve their margins.

If you are considering a less risky investment, you can look into inflation-indexed bonds. Unlike traditional bonds, the coupons for inflation-indexed bonds are not known upon subscription, since they will change according to inflation, which allows you to maintain the value of your capital.

Finally, you can invest in real estate and benefit from a rental real estate investment, for example. In addition, there are several ways to invest in real estate such as physical investment or real estate ETFs, which allows you to find the ideal solution for your profile.

To optimize your choices, think carefully about your investor profile, as well as your objectives, and to determine your investment horizon before getting started. It is also important to always diversify your portfolio according to the market context to obtain the best return for a specific level of risk.